Helping You Pay Your Employees in Canada

PaymentEvolution makes payroll easy - including domestic/international pay, compliance with Canadian regulations, tax deductions, and more.

Seamless Cross-Border Payroll

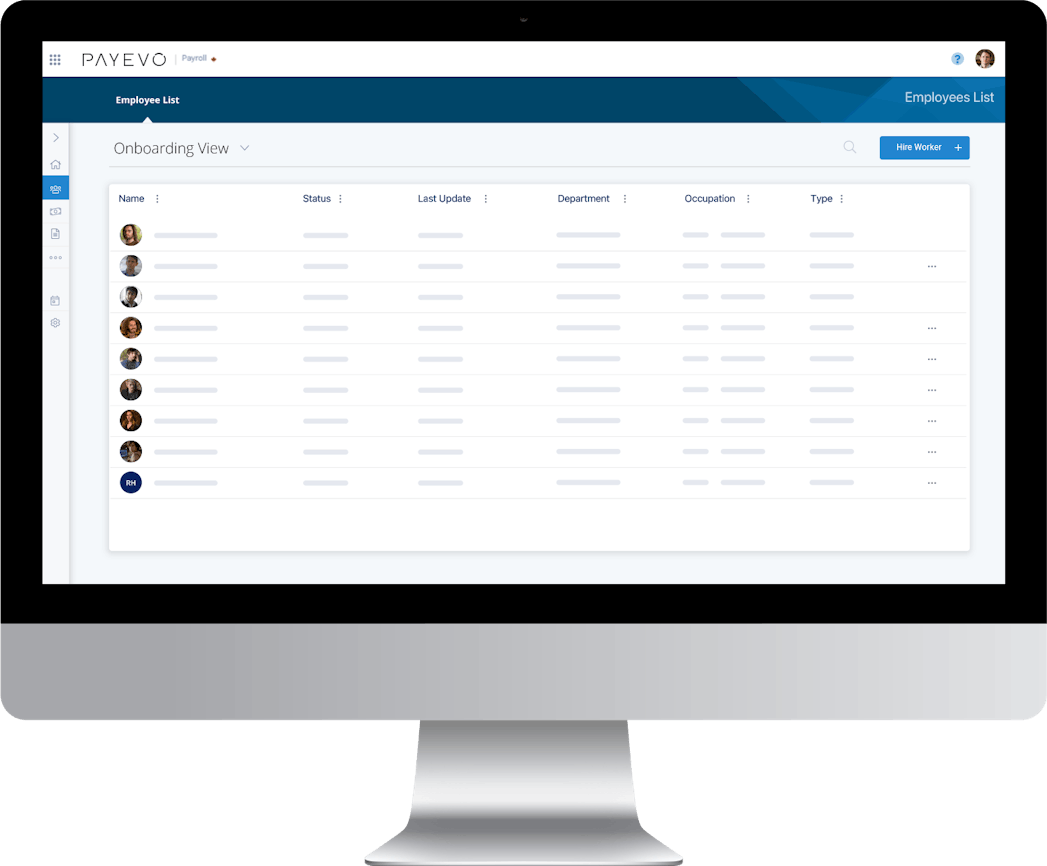

PaymentEvolution is a robust, self-service payroll platform that helps companies based in the United States pay their Canadian payroll. With expert guidance, we help companies like yours meet legislative requirements, comply with local Canadian tax rules, and make employee payments completely hassle-free.

Hiring Canadian staff?

Pay your Canadian staff in Canadian dollars with full compliance with local Canadian tax rules. We provide domestic Canadian payroll and remove the burden of setting up international offices and banking infrastructure.

A targeted solution for foreign exchange payroll

Converting funds from country to country can be complex. We make paying your Canadian staff as easy as sending funds to a US-based domestic account. Your staff receives funds in local Canadian currency and you don't need to worry about setting up banking infrastructure or compliance for foreign exchange. Our advanced platform works directly with your organization and staff remain your staff (not outsourced). Funds are directly deposited to recipients in full compliance with local Canadian tax rules.

Trusted by over

20,000 companies like yours.

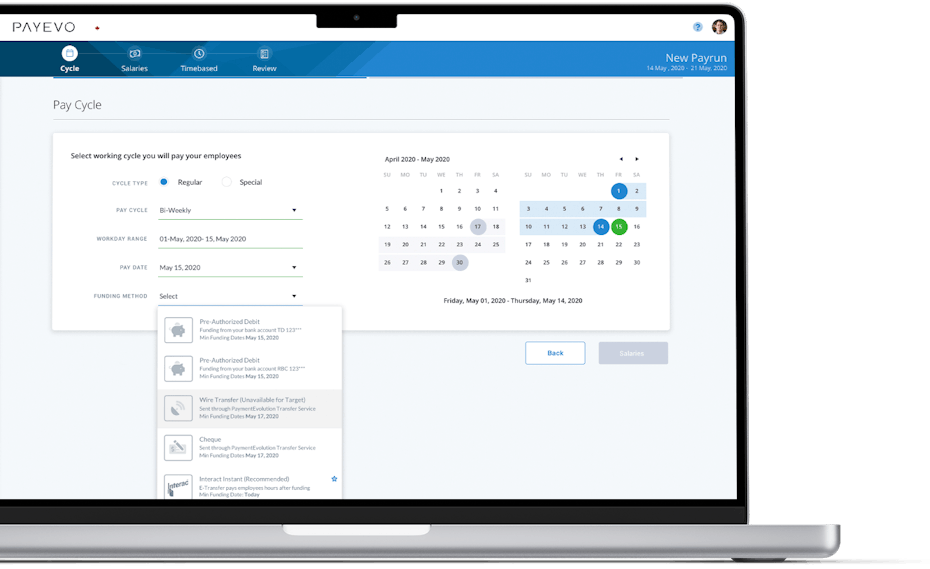

Simple setup and cross-border payments

It’s easy to get started with PaymentEvolution. You can set up an account in minutes and begin running payroll, in full-Canadian tax compliance with Canada's most trusted service.

You have access to report the amount calculated and will receive a USD amount to transfer to your Canadian employees (no more FX conversions).

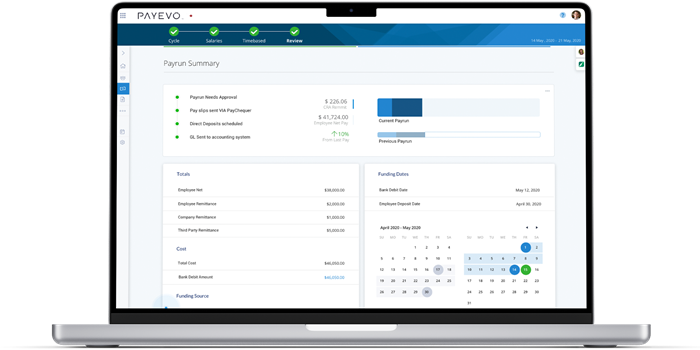

From there, PaymentEvolution handles the rest. Acting as the buffer between your organization and the Canadian government, we ensure you’re staying compliant by paying your employees and remittances.

International Business Plus

/employee/run

Up to 25 Employeess

- All the tools you need to pay Canadian staff (automated payslips, T4s, RL1s, HR, benefits and more)

- $900/year and bank fees may apply